Return on Capital

What is return on capital?

Return on capital is a ratio, expressed as a percentage, that measures the profitability of a business in relation to equity.

The indicator is used to determine how well a company generates profit growth from the money invested in the business. It is especially useful for evaluating a company’s performance in an industry and earnings relative to past performance.

A return in the region of 15-20% is considered good. A value above 20% may indicate very strong results, but also that the company’s management has increased the risk exposure of the business through asset-backed borrowing.

Profitability below 15% can signal a very conservative management of the company, as well as warn of problems.

How to calculate and use return on Equity?

Return on Equity = Net profit (annualized) / Equity

To get a complete picture of a company’s profitability, there are a few things to take into account. For example, the yield measure does not indicate whether a company is relying on debt to generate higher profits. If a company has used leverage to increase its return on capital, it has also taken on more risk, which could be a problem going forward.

Also, the profitability of the company can increase with the repurchase of shares, which reduces the denominator of the equation. In addition, returns in one company may not include intangible assets such as trademarks, copyrights, and patents, while they may be included in other companies in the industry.

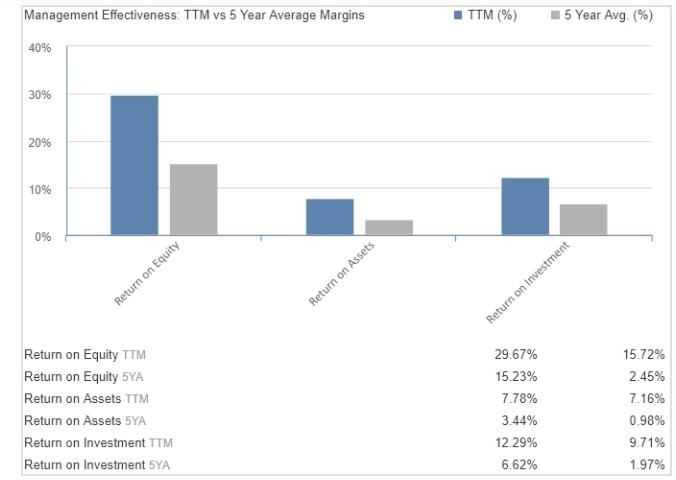

TTM’s current return on equity (twelve months) comes first in the table, followed by 5YA (average over 5 years). These numbers are also shown in the chart above the table for easy visual comparison.

Note that the first column on the right side of the table is the return on equity for the company, while the second column is for the industry. The second metric provides additional information about a company’s performance compared to peers in the same industry.