How to calculate gross profit?

Gross profit is one of the main indicators characterizing the results of a company’s economic activity. The calculation of gross profit – the formula is presented in our article – allows you to highlight promising areas of economic activity and redistribute financial flows to obtain a more efficient result.

What does the term “gross profit” mean?

Gross profit is one of the intermediate types of profit shown in the income statement. Accordingly, it is determined according to accounting data and represents the proceeds from the main type (s) of activity, reduced by the cost of sales.

The price of goods (works, services) sold is inextricably linked with investments in their cost. The cost consists of a set of costs of different types (material, human and other resources). Gross profit reflects the fact of profitability of sales (both all and broken down by type of activity) and allows you to determine how rationally each of the company’s resources is used.

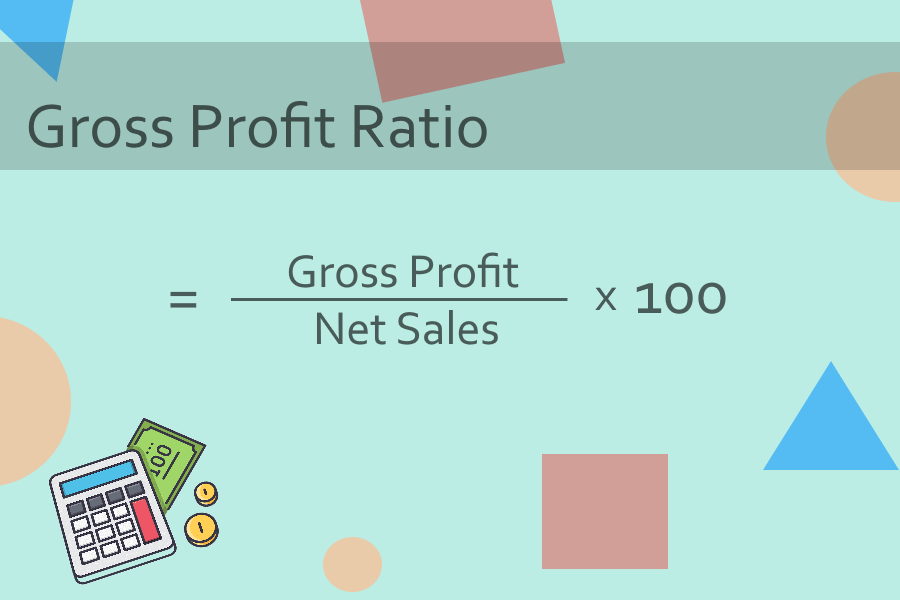

Gross profit is the difference between revenue and costs

Gross profit is determined by subtracting from the proceeds from the sale of goods (works, services) the costs of their manufacture (rendering) or acquisition. Revenue includes all amounts received from sales of core activities. They are taken into account without VAT.

The cost of manufactured (or purchased) goods includes all costs incurred for its production (acquisition). If a company provides services (performs work), then when calculating their cost (and subsequently gross profit), all costs associated with their provision are taken into account.

Gross profit is usually determined at the end of the month, quarter or year, but it can be calculated at any frequency and at any point in time – it all depends on the goals and objectives of the company, as well as the features of its management accounting.