What is inflation

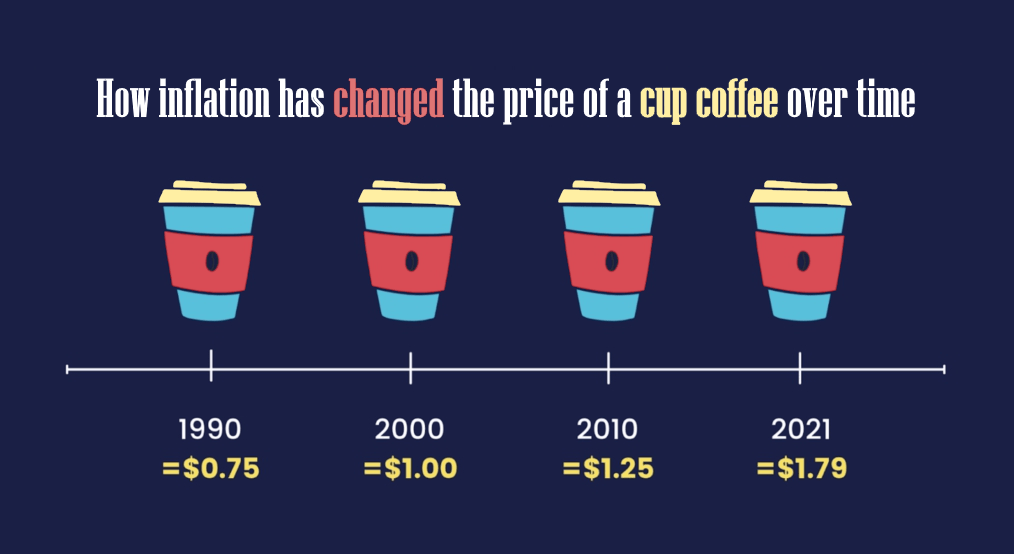

Inflation is the rate at which prices rise or fall over time. Because rising prices reduce future purchasing power by the same amount of currency, it is an important component of economic calculations and models.

A moderate level of inflation is considered economically healthy, while rapidly rising prices create hyperinflation, which leads to great instability.

The annual rate of inflation can be calculated for a single category or for the total goods and services of a country. To illustrate the first option, imagine that a year ago an apple cost $1.00, and today it costs $1.02. In this case, the inflation rate for the past year is 2%, that is, the percentage change in price for this year compared to the previous one.

How is inflation calculated?

In the United States, inflation is measured using various price indices, including the Consumer Price Index, the Consumer Price Index, and the Producer Price Index. The way these indices are calculated varies, which helps to determine where price pressure is present.

The Federal Reserve System (FRS) is responsible for the stability of inflation in the United States. The regulator has determined that annual inflation of 2% is the best to maintain upward price pressure without a significant decrease in purchasing power.

During economic growth, prices often rise as demand for goods and services increases. In an economic downturn, prices tend to fall as incomes and consumption fall. However, the average inflation rate for economic calculations and modeling is more often used for practical purposes.