September will not be the most fun

So, September doesn’t seem to be the most fun month for the stock market.

By the way, historically this month is not the best for the stock markets, and according to statistics, in September the markets tend to go down rather than up.

Well, here’s how it works out.

The beginning of the month is brisk.

▪️ DXY index – dollar against other currencies, at its maximum values. Already 109.1.

▪️ Ten-year yields of various countries are skyrocketing. Soon both the Bank of England and the FRS will “please” us with new greetings – strong rate hikes.

▪️ By the way, Japanese ten-years also flew up in terms of profitability. And we all remember very well that Japan’s debt is “only” some insignificant $9.5 trillion, and this is about 270% of the country’s GDP. Well, for understanding.

Markets react to everything that happens without enthusiasm.

The S&P 500 has walked almost 3900 from 4300 in recent days. At least the futures for this morning are almost there.

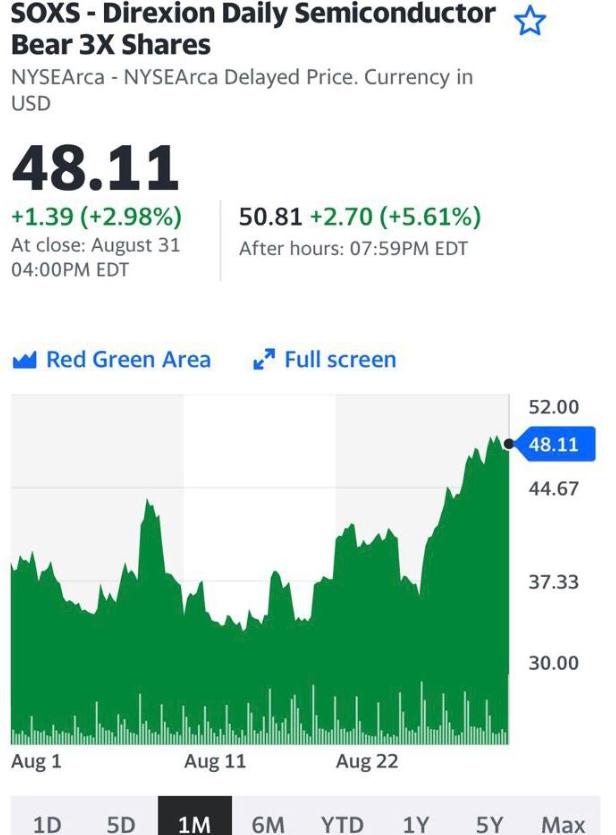

By the way, last night Biden signed a decree to block the supply of chips to China.

So a big shout out to NVIDIA (NASDAQ:NVDA), AMD (NASDAQ:AMD), and Intel (NASDAQ:INTC). For a long time now their quotes have been singing romances. And recently their flight “to the south” has intensified. Looks like it’s time to buy them soon.

What is there in Europe?

Clearance is also still not observed. Against the backdrop of another jump in energy prices, as well as a rise in food prices, inflation in the single currency zone in Europe set a new record in August – 9.1%.

Recall that in July the overall inflation in the euro area amounted to 8.9%. Against this backdrop, Chief Economist for Europe at Goldman Sachs, Sven Jari Sten, predicts an ECB rate hike of 75 basis points.

It seems that the ECB has no other options. But this exercise can throw the euro exchange rate up a little and temporarily.

As noted, nine eurozone countries registered double-digit inflation. In Lithuania and Latvia this indicator exceeded 20%. France was one of the few countries where the price index fell to 6.5%.

What is the danger of a further rise in prices?

Companies are being forced to revise their spending plans. As a result, the bloc could face a wave of layoffs and a slowdown in the economy. The news for the markets is not the best, hence the fall in European stocks. Following the results of yesterday’s trading session:

▪️ STXE 600 PR.EUR (^STOXX) index fell by 1.12%;

▪️ securities of energy companies STXE 600 OIL+GAS PR.EUR (SXEP.Z) lost 2.56%;

▪️ ESTX PR.EUR (^STOXXE) index lost 1.04%;

▪️ The EUR/USD pair, meanwhile, added about 0.25%. (Against the background of expectations of a strong rise in the ECB rate);

▪️ As for the debt market, German ten-years jumped over 12% in the last 5 days.

The situation, by the way, could worsen many times over if the German state lender refuses to provide German utility Uniper SE (ETR:UN01) with another €4 billion. Uniper still has an investment grade credit rating only because rating agencies expect Berlin to continue give her support.

To be honest, I think that I will continue to provide this support in the future. They won’t go anywhere. Nobody wants a new Lehman Brothers.

As noted by Fitch Ratings, investors’ concerns about the worsening economic outlook have affected the conditions of the primary debt financing market. This is evidenced by the decline in issuance of new high-yield bonds in Europe in the 2nd quarter.

What to expect next?

ECB rate hikes and worsening volume and profit margin forecasts in 2H 2022 will not only hurt corporate creditworthiness, but will also create problems for de-leveraging, debt servicing and refinancing. Against this background, the market may face a wave of downgrades.

In summary, the coming months in Europe promise to be quite interesting.

Well, in conclusion. What do I plan to do?

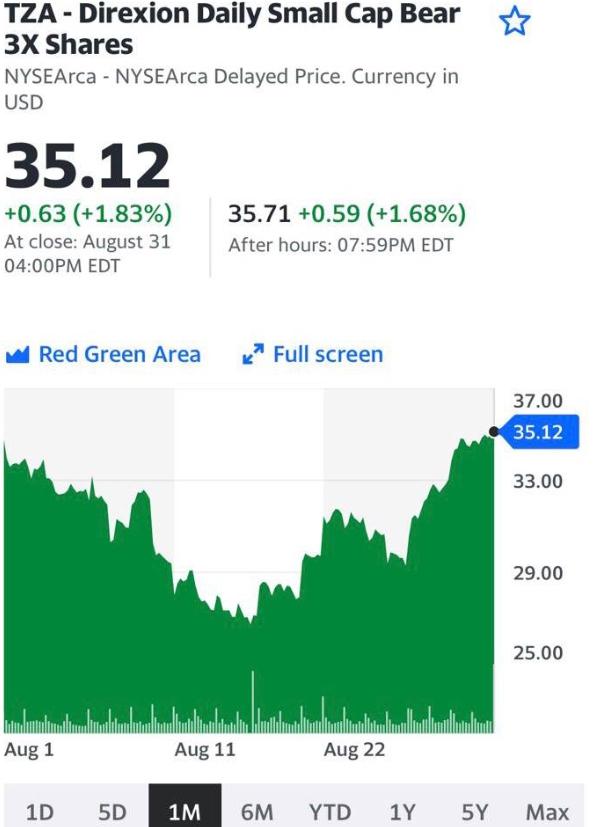

Well, since such pessimism has gone, and even a tanker in the Suez Canal managed to run aground short tools with a good profit (Insurance worked. And thank God.) and start slowly buying something decent.

I believe that the level of pessimism is quite high. Shorts have accumulated enough. It’s time for a little walk upstairs. Let’s say, for starters, to the level of 4150. And then we’ll see. So stay with us. Let’s share our ideas on this matter.

❗️ I want to warn you in advance.

Firstly, I don’t think that the forthcoming (perhaps) upward movement will be long-term and very strong. So I plan to restore short safety positions at the level of 4100-4200 again. Globally, I still expect the markets to be more than treacherous in the fall. And I will not rule out, as I said in my July forecast, a walk to the S&P levels even at 3200-3600.

And secondly, as you understand, all these are not recommendations, but just thoughts out loud. Perhaps I’m wrong. Anything can be. Life, as you know, is always arranged in such a way that not all forecasts work.