Will the Nightmare Inflation of the Late 70s Repeat?

Remember the popular TV series “That ’70s Show,” which aired from 1998 to 2006? It tells the story of the lives of six teenagers in Wisconsin in the late 1970s. The irony is that the actors portraying these teenagers didn’t live during that period themselves. Many today can’t even imagine life without the internet, cable TV, mobile phones, and social networks.

Yet, almost 50 years later, financial observers, many of whom weren’t even born then, think that the situation with inflation and yield from the late 70s might repeat itself. The growth of inflation and interest rates from historical lows, understandably, causes concerns. As James Bullard noted, “inflation is a devastating problem,” and therefore the Federal Reserve System (FED) has taken decisive measures.

“When the U.S. Federal Reserve began an aggressive campaign to curb inflation last year, they aimed to avoid a repetition of the painful events of the 1970s when inflation got out of control, and the economy encountered serious problems,” – CNN.

The “inflation spiral” remains the main concern for the FED when making decisions about monetary policy. It also prompted many economists to turn to history and use the late 70s as a benchmark in explaining why they are so concerned about the surge in inflation.

“The then Chairman of the FED, Arthur Burns, sharply raised interest rates from 1972 to 1974. Then, when the economy began to decline, he changed direction and began to lower rates.”

Inflation subsequently intensified sharply again, forcing Paul Volcker, who took over the FED in 1979, to take action. Volcker subdued double-digit inflation, but in doing so, he raised borrowing costs to such an extent that it triggered two consecutive recessions in the early 1980s when the unemployment rate at one point rose above 10%.

“If they don’t stop inflation now, judging by the historical analogy, it won’t stop but only get worse,” notes Gary Richardson, Professor of Economics at the University of California, Irvine.

However, this hint that Burns was wrong and Volcker was right perhaps oversimplifies the picture. The fact is that today’s economy is very different from the economy of the “That ’70s Show” era.

It’s Not the Late 70s Now

In the 70s, the FED was strenuously fighting inflation. The collapse of the Bretton Woods system and failed attempts to control wages and prices, coupled with the oil embargo, led to a sharp surge in inflation. Markets then collapsed under the pressure of rising interest rates. Numerous oil shocks, a spike in food prices, wages, and budget pressure led to stagflation, which persisted until the end of the decade.

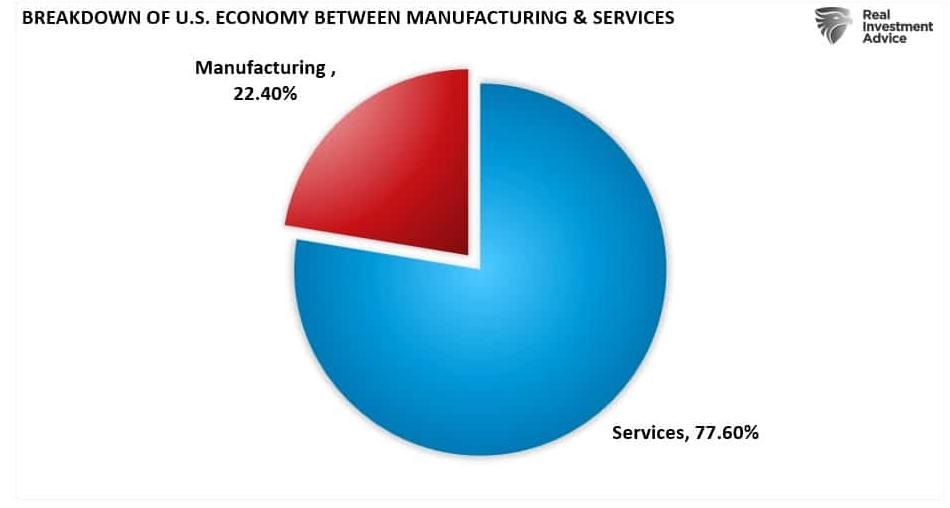

What’s most noteworthy is the fight against inflation that the FED was waging at that time. Just like today, the FED was raising rates to suppress inflationary pressure caused by external factors. In the late 70s, the wave of inflationary pressure was caused by the oil crisis. Rising oil prices then seeped into an economy dominated by manufacturing activity. Today, however, inflation has resulted from monetary interventions that stimulated demand in an economy suffering from supply chain issues.

And this is the key point. The economy of the late 70s mainly relied on the manufacturing sector with its high multiplier effect. In today’s economy, it is the opposite – the lion’s share of economic activity is in the service sector. And although services are vitally important, their multiplier effect is very low.

One of the main reasons for this is that the service sector does not require as strong wage growth as the manufacturing sector.

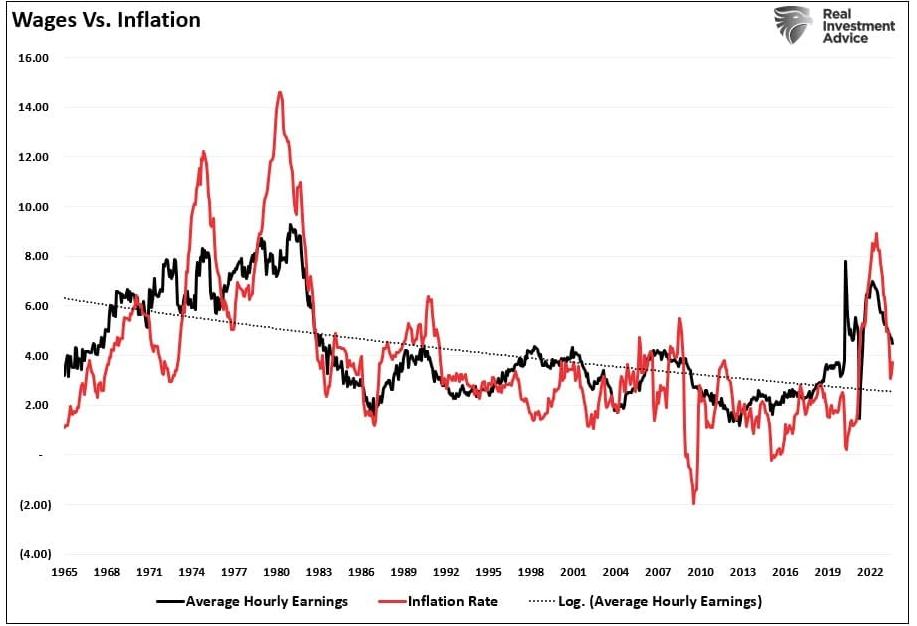

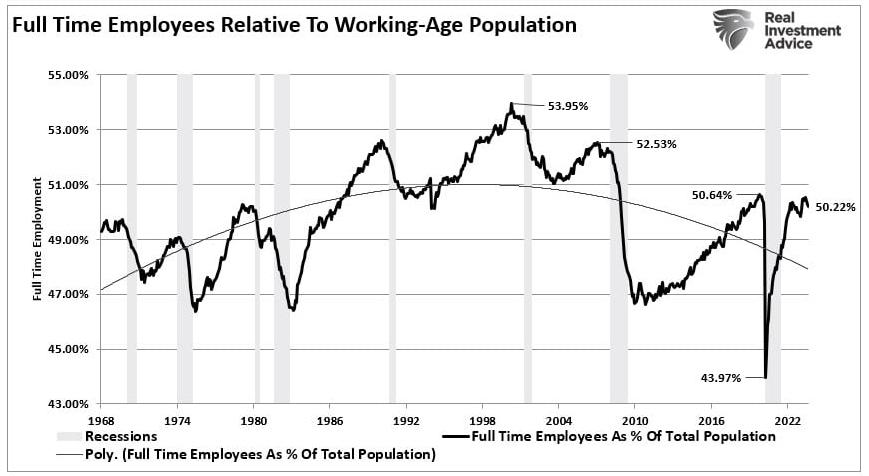

Although wages have sharply increased over the past couple of years, this occurred as a result of a slowdown in economic activity, which created a gap between demand and supply in the employment matrix. As can be seen, the share of full-time employment sharply decreased during the pandemic. However, as full employment recovers to pre-COVID levels, wage growth begins to slow down as employers regain control over this balance.

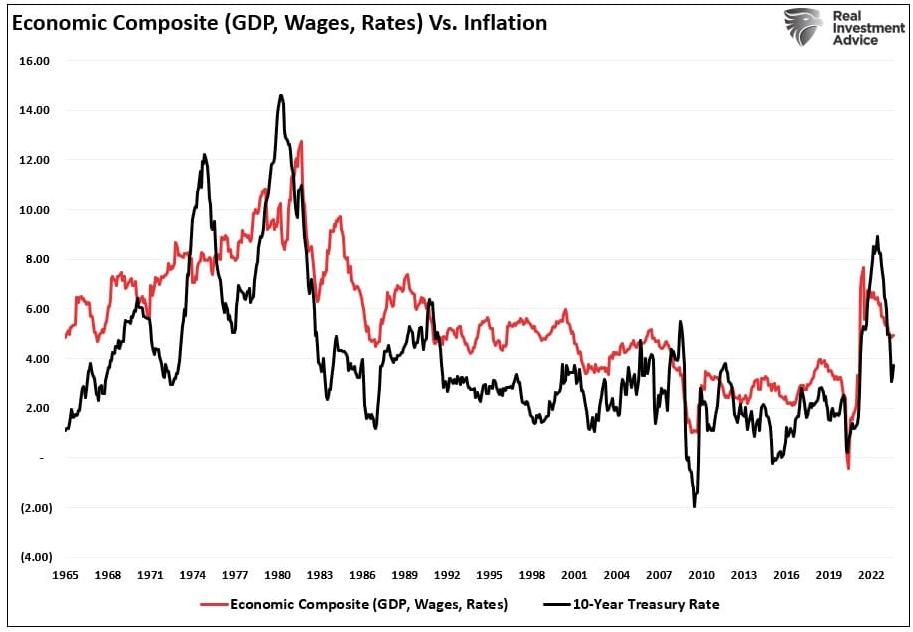

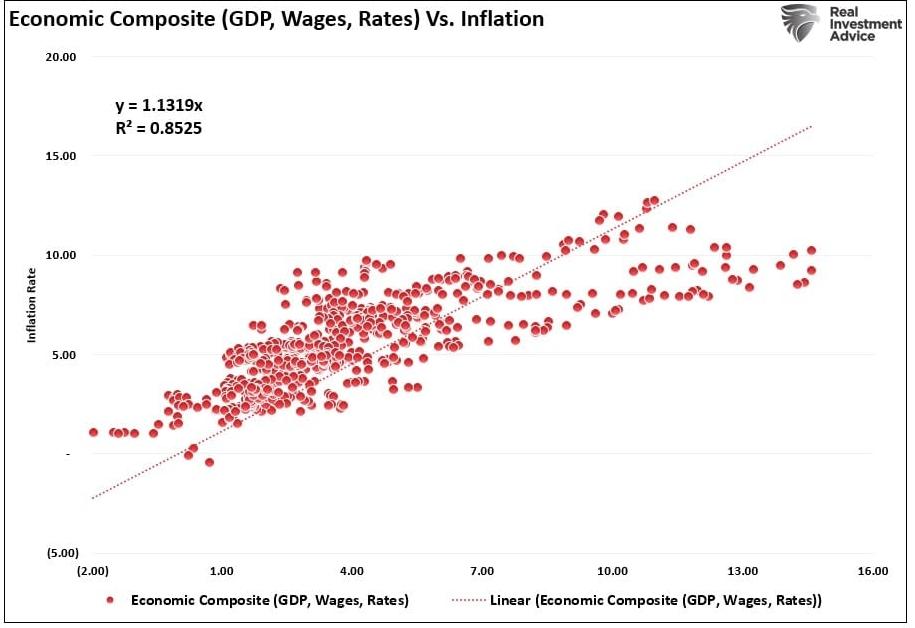

Moreover, since the late 70s and up to the present time, there has been a close correlation between inflation, on one hand, and wages, interest rates, and economic growth, on the other. It turns out that inflation increased along with the imbalance of demand and supply caused by lockdowns, and the normalization of the situation should have led to a reduction in inflation along with a slowdown in economic activity.

With an 85% correlation, a decrease in inflation should coincide with a slowdown in the rates of economic growth, interest rates, and wages.

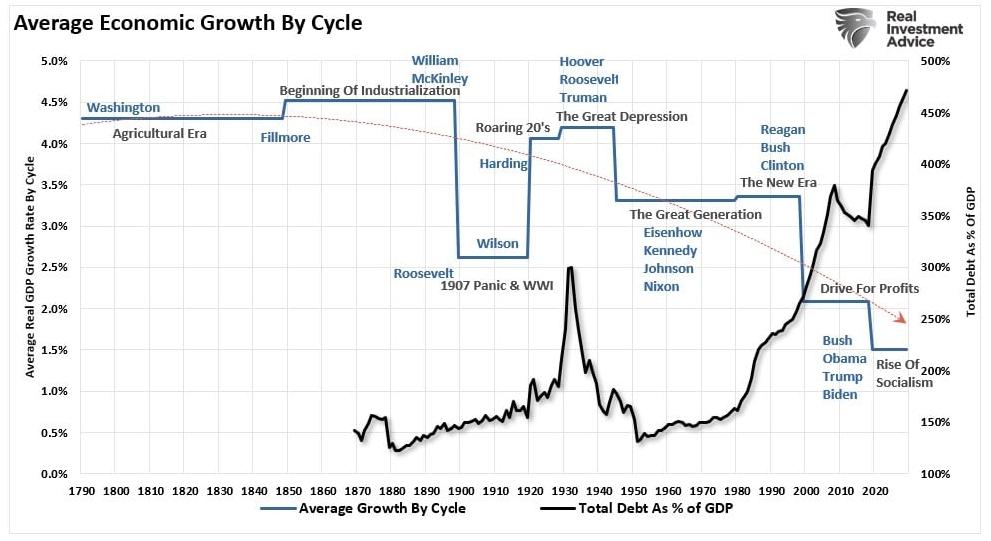

In the late 70s, the rates of economic and wage growth were steadily increasing, meaning higher levels of interest rates and inflation. Today, however, there is one specific reason why a repetition of that period is impossible.

Tax Burden and Economic Weakness

The late 70s were the culmination of events that followed World War II.

After the war, America was the last surviving economy. France, England, Russia, Germany, Poland, Japan, and other countries were devastated and could produce almost nothing. In the USA, impressive economic growth began when American soldiers returning from the front started rebuilding the world anew. But this was just the beginning.

By the late 50s, with humanity’s first steps into open space, America was in uncharted territory. The nearly 20-year-long space race led to a rapid development of innovations and technologies which, in turn, laid the foundation for the future America.

These successes, combined with the strength of industry and the manufacturing sector, ensured high rates of economic growth, an increase in savings, and investments in capital markets, which, in turn, led to higher interest rates.

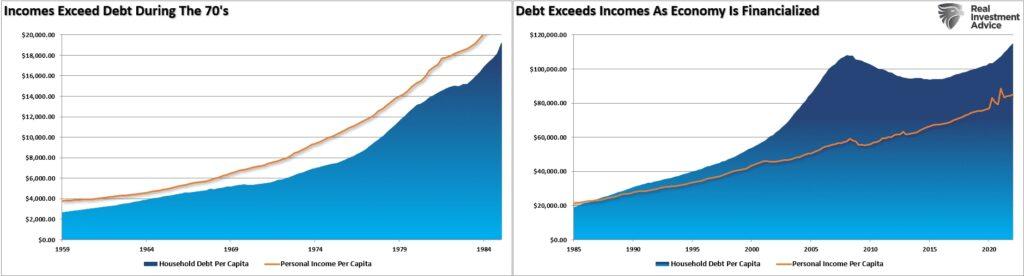

The government then balanced the budget without a deficit, and the ratio of household debts to the net value of assets was about 60%. So, the average household managed to maintain its standard of living despite the rise in inflation and interest rates. The graph below shows the difference between the ratio of household debts and incomes before and after the era of “financialization.”

Now, when the budget is drafted with a deficit, the debt exceeds $32 million, the volume of consumer debt is at record highs, and the rates of economic growth remain unstable, it is not so easy for consumers to cope with the rise in inflation and interest rates.

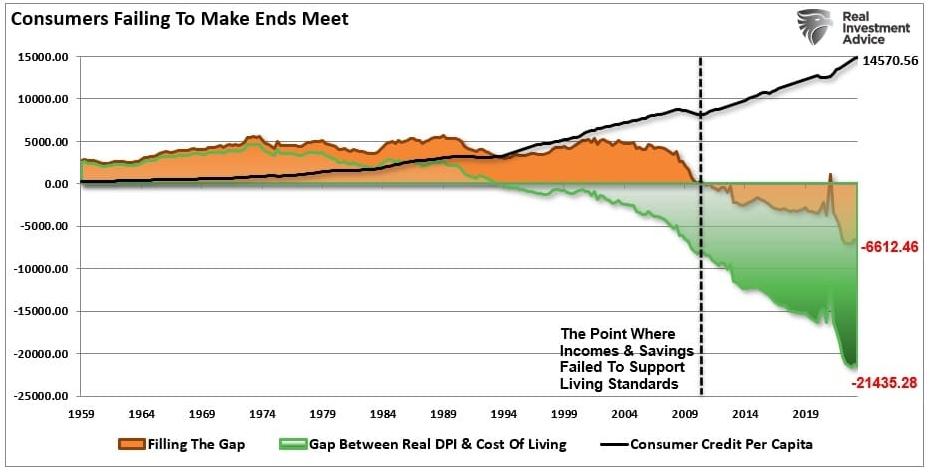

As we noted earlier, the gap between incomes and savings to maintain the standard of living is currently at record levels. The graph below reflects the gap between the cost of living adjusted for inflation and the spread between incomes and savings. To bridge this gap, a consumer would now need to borrow over $6500 a year.

These Are Different Times Now

Although the FED, as in the late 70s, is now fighting the “main battle of its life,” trying to curb inflation, today’s economy is structured quite differently. Due to the high debt load, it requires lower interest rates to maintain even weak growth rates of 2%. In the past, such rates were considered a precursor to a recession, but today economists would be happy with even such economic growth.

This is the main reason why low rates of economic growth will persist. Therefore, the economy will be characterized by:

- more frequent recessional periods;

- lower stock market returns; and

- stagflationary conditions, where wage growth will remain under pressure, while the cost of living will continue to increase.

These issues will be exacerbated by changes in structural employment, demographic situations, and deflationary pressure associated with changes in the level of productivity.

Many now are hinting that the FED is afraid of a repeat of the late 70s. Yet we can only hope for such growth rates that would make such fears justified.

The main concern for the FED should be the breakdown of the debt-overloaded financial system under the impact of high rates.