Stagflation is already inevitable. How to make money on this?

Many economic indicators point to the approaching period of stagflation. This is evidenced by the highest inflation rate in forty years, slowing economic growth, as well as stable supply chain problems and geopolitical tensions in the Taiwan Strait.

Together, these factors warn of high inflation and slower economic growth in the near future.

The real estate market has a very heterogeneous structure. For example, more conservative triple net lease REITs (the tenant must pay all costs of the property), such as Realty Income Corp (NYSE:O) and Store Capital Corp (NYSE:STOR), are great for periods of slow economic growth and even recession, but do not fare too well with high inflation.

On the other hand, hospitality REITs such as Host Hotels & Resorts Inc (NASDAQ:HST) perform well during periods of high inflation but are susceptible to economic downturns. Fortunately, some types of real estate are resistant even to periods of stagflation.

Among the REITs that are particularly well-adjusted to the current environment, two stand out: AvalonBay Communities Inc (NYSE:AVB) and Medical Properties Trust Inc (NYSE:MPW). In this article, we will take a look at them and determine why they are not only a good fit for current conditions, but also have good upside potential.

Avalon Bay Communities

The first thing that catches your eye here is that AVB’s share price is currently lower than it was before the start of the pandemic in 2020. This should mean that the company has been hit hard, or at the very least, is currently experiencing serious economic difficulties.

However, this is not the case at all, as AVB is benefiting from rapid growth in rental prices (since the start of the COVID-19 pandemic, the average rental growth rate in the US has been 20%), high real estate values and acquisitions of new properties in attractive markets (for example, Texas and Florida) .

While multi-family housing construction is on the rise – meaning supply and demand could reverse in the coming years – current supply chain challenges are making it difficult for many of these properties to go online, holding back supply amid rapidly growing demand.

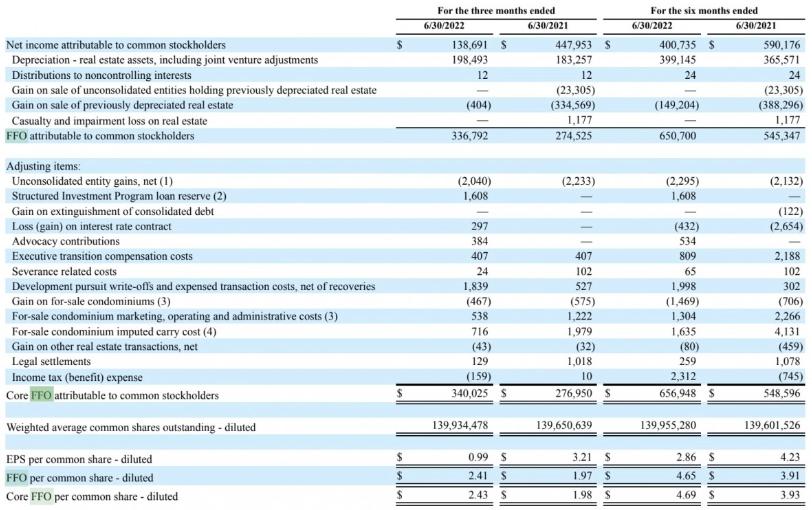

As a result, AVB shows simply amazing results. In the second quarter, FFO (operating income) per share rose 22.3%.

As a result, management raised its full-year guidance to an average of $9.86. This means that in 2022 the P/FFO ratio will be 21.1x, i.e. will be below the five-year average (22.9x) and the three-year average (24.0x). This is despite the fact that the company clearly benefits from high demand for apartments, rising inflation (which benefits AVB because the company enters into short-term leases and can increase rents every year) and owning a reliable asset – residential real estate.

In addition, the company offers investors good dividends (3.2%). Yield growth prospects look promising given double-digit AFFO (Adjusted Cash Flow from Operations) per share growth, a 3.2% dividend and the potential to benefit from a multiple expansion. Add to that an A- (stable) S&P credit rating and a generally sound position for residential real estate REITs, and the risk/reward ratio is very enticing.

Although in a few years the active commissioning of new real estate may weaken the position of AVB, but at the moment the risk remains quite low, especially compared to the potential return.

Medical Properties Trust

MPW is also in a fairly secure position as it leases hospitals, which are critical facilities. In addition, it operates under a long-term triple net lease with a conservative structure. While hospital revenues may decline during a recession, as many non-emergency surgeries are delayed during such periods, demand for real estate itself is likely to remain high, as the need for health care is independent of the state of the economy.

However, unlike many similar triple net lease companies, MPW provides for inflation adjustments in its lease agreements. This provides reliable protection and allows the company to feel good even in stagflation.

In addition, MPW shares are once again trading near COVID-19 lows as investors grow more concerned about the dire financial condition of tenants. However, we believe these fears are unfounded, as the company’s tenant coverage is around 2.5 at the property level.

Accordingly, these assets are very valuable and will be in demand even if the operators go bankrupt at the company level. Moreover, in the event of a tenant going bankrupt and failing to meet their lease obligations, MPW has the right to take the property and transfer it to another tenant.

Given that these properties are highly profitable, it is unlikely that tenants will default on these leases, even if they have to file for corporate bankruptcy. Even if tenants default, MPW will be able to release these attractive properties to new clients. After all, we are talking about highly profitable, critically important, well-located healthcare facilities. People will use them regardless of whether the current tenant is solvent or not.

MPW recently sold its stake in some hospitals operated jointly with its largest tenant (Steward) at a capitalization rate of 5.8%. Therefore, many of the company’s critics are concerned about its possible bankruptcy. With this rate well below that of MPW’s current share price, it appears that the private and public markets are sharply divided on the true value of MPW property and the security of its lease.

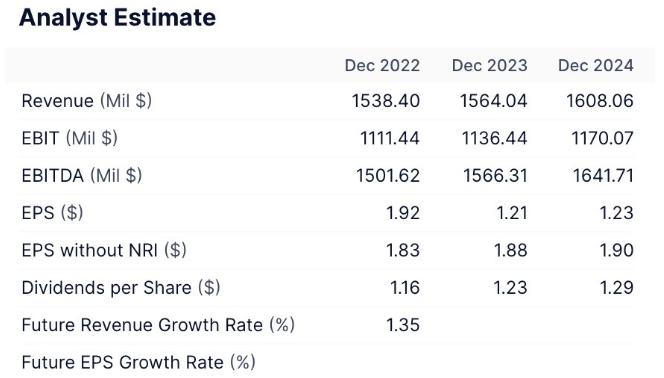

In fact, given the defensive nature of the assets, the high profitability of the property, and its resilience to inflation, the company’s heavily undervalued figures seem even less justified:

As you can see from the table, the price of MPW seems to be very low in all respects – especially in relation to price to net assets. Meanwhile, the company’s management continues to show confidence. They have already raised their dividend this year, and analysts expect MPW’s annual dividend growth to 2026 to be 4.4% year-on-year.

While MPW is not a risk-free or even low-risk asset, there is definitely a significant mismatch between the price and the company’s true value.

Conclusions for the investor

With inflation and slowing economic growth, investors are looking for business models that can provide protection. In addition, the current value of the company must be reasonable, which will ensure a good income in both the long and short term.

Investments in AVB and MPW meet all these requirements. AVB has exceptional double-digit growth potential along with good dividend yield and low risk. MPW is a high-yield investment with attractive current returns, significant potential for multiple expansion, and high growth rates that are somewhat inflation-proof.

Collectively, investors enjoy a good average dividend yield and average growth rate, good multiple expansion potential and inflation protection, and a relatively low level of risk. Both of these REITs definitely deserve to be on your watchlist and are highly recommended for any drawdowns.