Two stocks that will get you closer to your dividend pension

Today, the Financial Independence and Early Retirement (FIRE) movement is gaining popularity among young people. However, many of them lack knowledge and invest in low yield instruments or passive ETFs. We will take this idea as a basis and increase its yield to 9% and above.

I have always watched the FIRE movement with great interest. I am inspired by people who plan their financial future first and are motivated to achieve their goals.

But I also find it funny that many of them save and keep working hard. But in the end, they fail to achieve high returns, and the main source of capital remains at work. They leave huge potential untouched.

I read blogs and watch YouTube videos of some of the followers of this movement, and the reason is immediately apparent. By their nature or profession, they are not smart investors. Many of them are highly skilled, talented, and hardworking individuals, but if they took the time to learn, they would learn that a dividend investing strategy can greatly accelerate the achievement of their goals.

Today I will talk about two highly profitable companies that are highly likely to increase their dividends in the future. Investing in such companies will allow you to retire faster and maintain a high level of income longer.

ORCC. Yield 9.2%

Net income from investment Owl Rock Capital Corp (NYSE:ORCC) reached $0.32 per share and fully covered the dividends paid. As the company’s management said during a conference with investors, the forecasts for the future are even brighter. This is how management comments:

“At the end of the second quarter, the LIBOR rate for three months was 2.3%, that is, the base rate for such borrowers became higher. Ceteris paribus, if base rates in effect as of June 30 had been maintained throughout the second quarter, we estimate that second-quarter net interest income would increase by $0.02 per share to $0.34 . Moreover, in the third quarter, borrowers will continue to change interest rates, which will contribute to the growth of our portfolio and net interest income.”

As we know, interest rates have been rising since the end of June. The Fed intends to continue to raise rates. Rising interest rates are extremely beneficial to the business model of companies like ORCC, as most of their loans are floating rate.

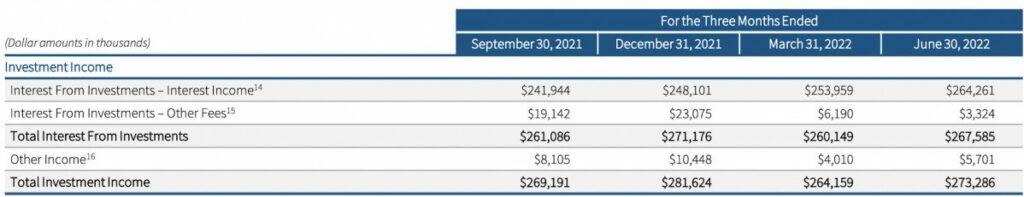

Over the past year, ORCC has been working on increasing leverage. Periodically, the company failed to cover dividends. In the past two quarters, she has managed to cover the dividend through regular interest income. Below is the income structure of ORCC.

Note that over the past two quarters, “other fees” and “other income” have been very low. However, this did not stop ORCC from covering dividends in both quarters. In addition, the company will easily cover them in the future as interest rates continue to rise. Overall, we see the potential for higher dividends as regular interest income continues to rise. And even a quarter ago, we could not say this with certainty.

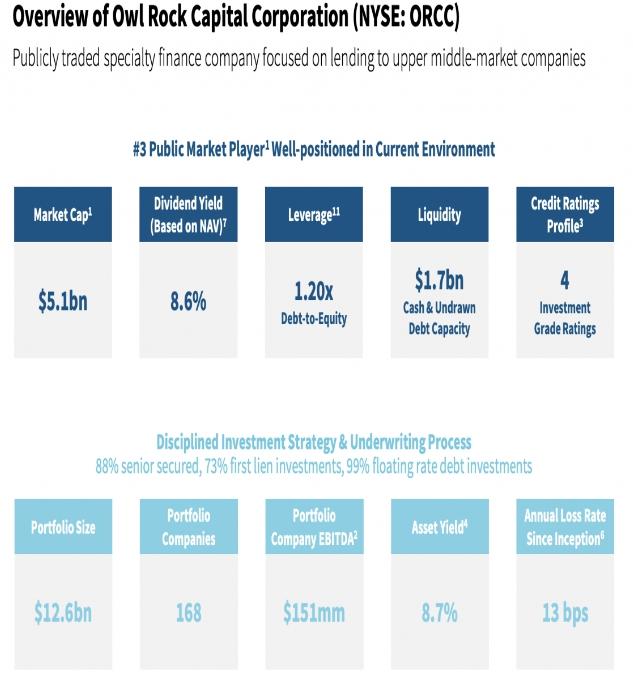

Compared to other BDCs, ORCC most closely resembles Ares Capital (NASDAQ:ARCC) in its early stages. It is now the third largest publicly traded BDC, and uses its scale to invest in “upper mid-market” companies. The average ORCC borrower has EBITDA of $151 million per year.

Despite the fact that the ORCC portfolio is estimated at $12.6 billion, each company in it accounts for only 2-3%. The credit quality of the portfolio remains consistently high: only one company pays no interest, but it accounts for only 0.1% of the portfolio.

Every day ORCC is getting stronger. Its earnings are rising, its dividend coverage is improving, and the company isn’t taking on much risk.

Shareholders may purchase ORCC shares at a discount to book value. We are earning high returns right now and are likely to see a higher dividend by the end of this year or early next year. Here is how the company’s management evaluates dividends:

“I think we have everything we need to just increase the base dividend, or we can pay a special dividend due to income growth. This will depend on the specific situation in the future. While it is difficult to make any assumptions. Currently, accordingly, everyone sees the situation with rates in this vein and believes that it will continue in the foreseeable future, and quite possibly until the end of the year. But there are different points of view on the situation with rates.

But I can promise that the board of directors is watching the situation closely, and we want to continue to pay out high returns to shareholders. And if we are confident that the returns will continue to be high, we will seriously consider ways to share them with shareholders. I hope we have answered your question.”

You can’t be sure about a dividend increase until it happens, but I love it when the board discusses an increase with current payouts already over 9% per annum! Who said that you have to choose between high yields and dividend growth?

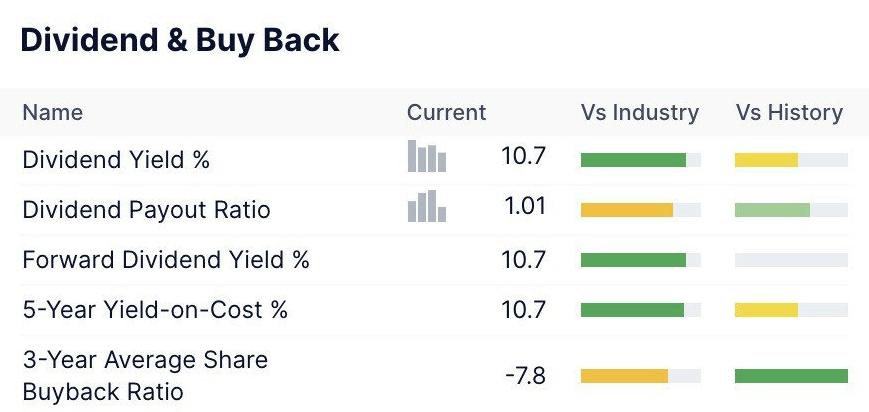

TPVG. Yield 10.7%

When the RIC (regulated investment company) I own shares issues, I automatically buy them. For one simple reason: companies issue shares to grow. For such companies, issuing shares is the main way to expand. To maintain tax status, they are required to distribute the majority of their taxable income. This means they can’t skimp on dividends like tech companies, or, without even consulting shareholders, allocate all the money to invest in “growth” projects that may or may not create value.

I once watched a TV show about a couple who opened a restaurant together. In one scene, the restaurant manager informs the investors that they will not receive a dividend this year. The manager decided to reinvest all profits in the construction of a new hall in the basement. Please note that investors have been participating in the project for about 1.5 years and during this time they have not seen a single cent.

Perhaps the investors were holding their own because they were shown on TV. And I? I would be furious. Pay me my dividends and then talk about your great expansion plans and I’ll decide if I want to spend on them. Don’t waste my money and tell me about it after the fact!

RIC dividends are usually above average. If such companies want to expand, they need to raise new equity capital. The company cannot keep the money for itself and dispose of it at its own discretion. I receive dividends and then decide if I want to buy even more shares of this company. As a general rule, if I still own shares in the company, that’s a very good sign that I want a bigger stake, so more often than not, I keep investing.

Triplepoint Venture Growth (NYSE:TPVG) is the latest company in my portfolio to go public. She raised capital to pay off the loan and invest in new opportunities. The best part is that the company did this immediately after making a profit, so shareholders had the opportunity to see the current state of affairs before it entered the market for additional capital.

Net investment income was $0.41 per share in the second quarter, well above the $0.36 dividend. TPVG’s “excess” accumulated retained earnings was $0.46 per share. This is undistributed taxable income, which will eventually need to be distributed to shareholders.

TPVG continues to show strong performance and strong leverage, in line with management’s announcements last quarter. During the quarter, the company closed deals for $260 million and signed letters of intent for $804 million.

Notably, over the past year, TPVG’s prepaid yield has risen from 12% to 12.8%. Compare 2022 and 2021: Portfolio up, company earnings up, more deals done (growth in the future), net investment income $0.41 vs $0.30, net asset value per share $13.03 vs $13, 01$, but the share price is lower!

TPVG is actively working, already increasing its income today and plans to earn even more in the future. So when TPVG comes in and asks for more capital, I’m happy to buy more shares. Also, I’m happy to invest in a company that honestly asks for more funds instead of just keeping my money.

Conclusion

ORCC and TPVG offer well-covered dividends to their investors. Both companies are actively working and bring me a good dividend income. I fully support the determination of the followers of FIRE. Reliable dividend companies can quickly multiply the funds invested in them. They will also help you get a clearer picture of your passive income. This way, you can easily determine if you are close to the goal, overfulfilled, or not yet reached it.

But even for those who do not follow the FIRE approach, the question of income in retirement is still relevant. Everyone needs retirement income and a clear plan for receiving it already at the stage of accumulating pension funds. Therefore, it makes sense to invest in companies such as ORCC and TPVG.

This way we will have money when we need it most. This is the advantage of dividend investing and the main goal of the income method.