Stock market live updates: Stocks rise after two-day Powell sell-off

US stocks rose on Tuesday as Wall Street tried to overcome a two-day slump caused by fears of further monetary tightening by the Federal Reserve to fight inflation.

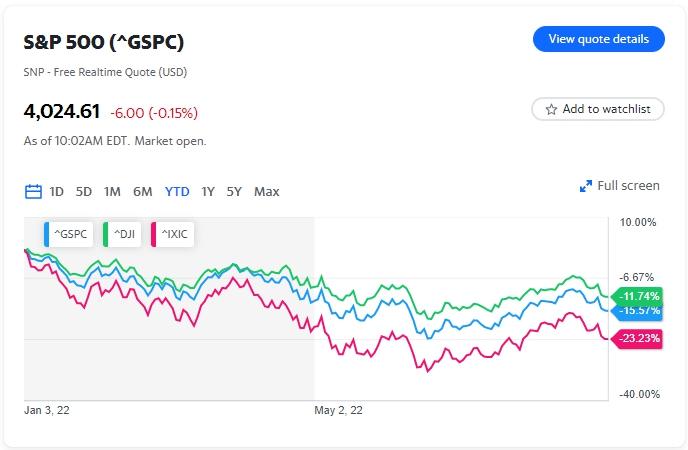

The S&P 500 rose 0.3% after the benchmark lost about 4% on consecutive losing days and the Dow Jones Industrial Average gained 75 points, or about 0.2%. The high-tech Nasdaq Composite rose 0.6%.

In commodity markets, oil prices fell due to renewed fears that a global recession could affect demand. West Texas Intermediate crude fell 2.7% to $94.39 a barrel, while Brent futures fell 3.4% to $101.48 a barrel.

In other markets, Bed Bath & Beyond Inc. shares. (BBBY) was up 10% in early trading on Tuesday after gaining 25% in the previous session, as investors anticipate strategic updates from the company later this week. . The meme title has skyrocketed this month and is on track for a record monthly increase in August after rising over 170%.

Shares of Chinese search engine Baidu (BIDU) fell more than 2% after posting higher-than-expected quarterly earnings, boosted by the growth of its cloud business. However, the company reported its first quarterly decline in annual revenue in two years.

In economic data, the Standard & Poor’s CoreLogic Case – Shiller Home Price Index posted an 18.0% year-over-year increase in June from 19.9% in the previous month. The 20-City Composite is up 18.6% from 20.5% last month.

Investors also have Conference Board consumer confidence and JOLTS employment opportunities at their fingertips. But the main event of the week will be the monthly update of the Ministry of Labor.

“The stock had a reasonable chance of hitting another weekly high last Thursday, but the bearish reaction to Powell’s performance at Jackson Hole sent the market down sharply,” said Chris Larkin, managing director of E*TRADE Trading. Morgan Stanley in a note. . “While this is a busy week of economic data, Friday’s jobs report will be the most popular as investors and the Fed reread labor market data.”